DO YOU WANT TO

SCALE YOUR AUM?

Claim Your Strategy Call Below.

Learn How To Build One Cohesive Client Acquisition System Which Allows You To Grow Your AUM Predictably, Month On Month

AUM Growth Is Not Luck

- it's engineered.

A MESSAGE FROM

Sam Burrows

- FOUNDER OF BURROWS & PARTNERS

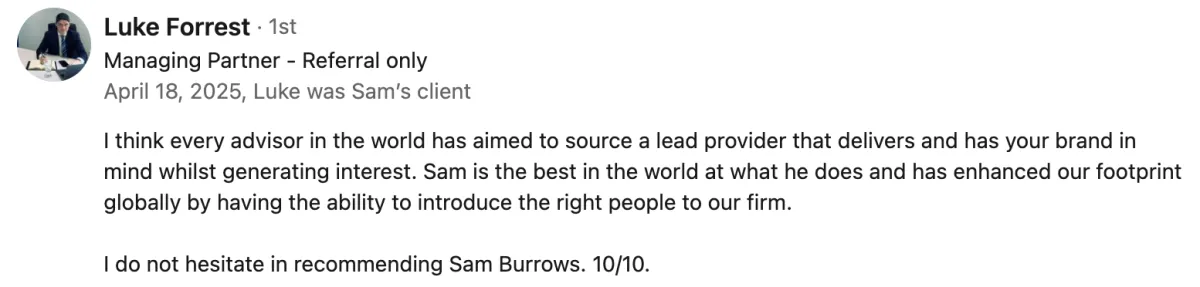

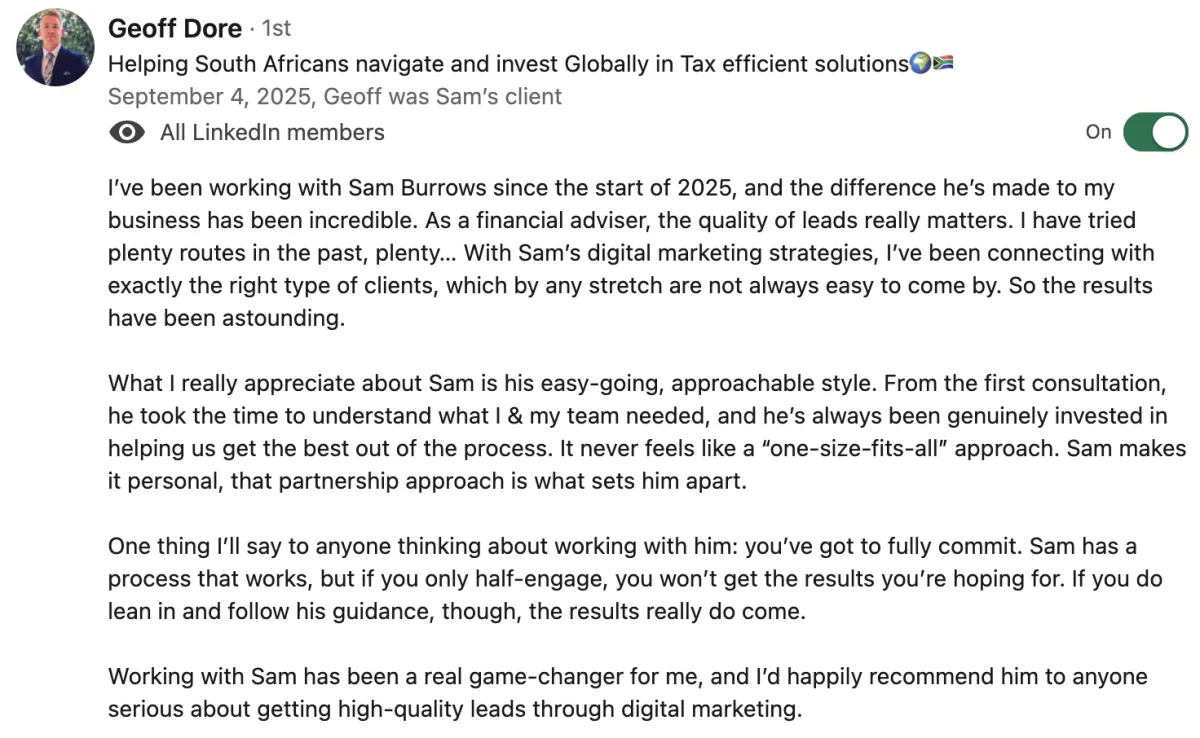

I often get asked how what we do is different, mainly because our clients were first burned by lead generation companies in the past.

There are many differences, but perhaps the most pivotal is that prior to Burrows & Partners, I was part of a multi-billion-dollar wealth management client acquisition engine.

And I have personally spoken to over 10,000 pre-retirees and retirees, about their retirement. Which means I understand your business, you don't have to waste time explaining anything, and most importantly - I understand what drives your prospects. To be totally honest, I have been obsessed with that topic for the last 4.5 years.

For context, my first introduction to the wealth management industry was working within the private client arm of Fisher Investments.

Despite Fisher being a very large $350bn+ firm, they still continue to achieve incredible growth - circa 20% per annum since the late 70s.

They also sold a part of their firm in January 2025 for $3bn, at a REMARKABLE 21x EARNINGS! (Source: Citywire, 2025).

The reason it was so high? Fisher run a well-oiled client acquisition machine. One that compounds AUM growth in a predictable, scalable, manner, month on month.

And they're doing so whilst most of the industry is stuck in an old, outdated way of doing things.

In the UK, it's usually a large reliance on third parties and time consuming client acquisition methods. Networking events, B2B introductions, or waiting for referrals and inbound leads.

The offshore space is typically the complete opposite - low leverage methods that lack trust and require you to hire, train and manage demoralised BDM's. Cold outbound, cold calling and data digging.

When I left Fisher in 2023, I realised this was the case and knew there was a better way, so I founded Burrows & Partners.

Since starting Burrows & Partners, we have been responsible for client acquisition campaigns in over 63 different countries and 5 different continents.

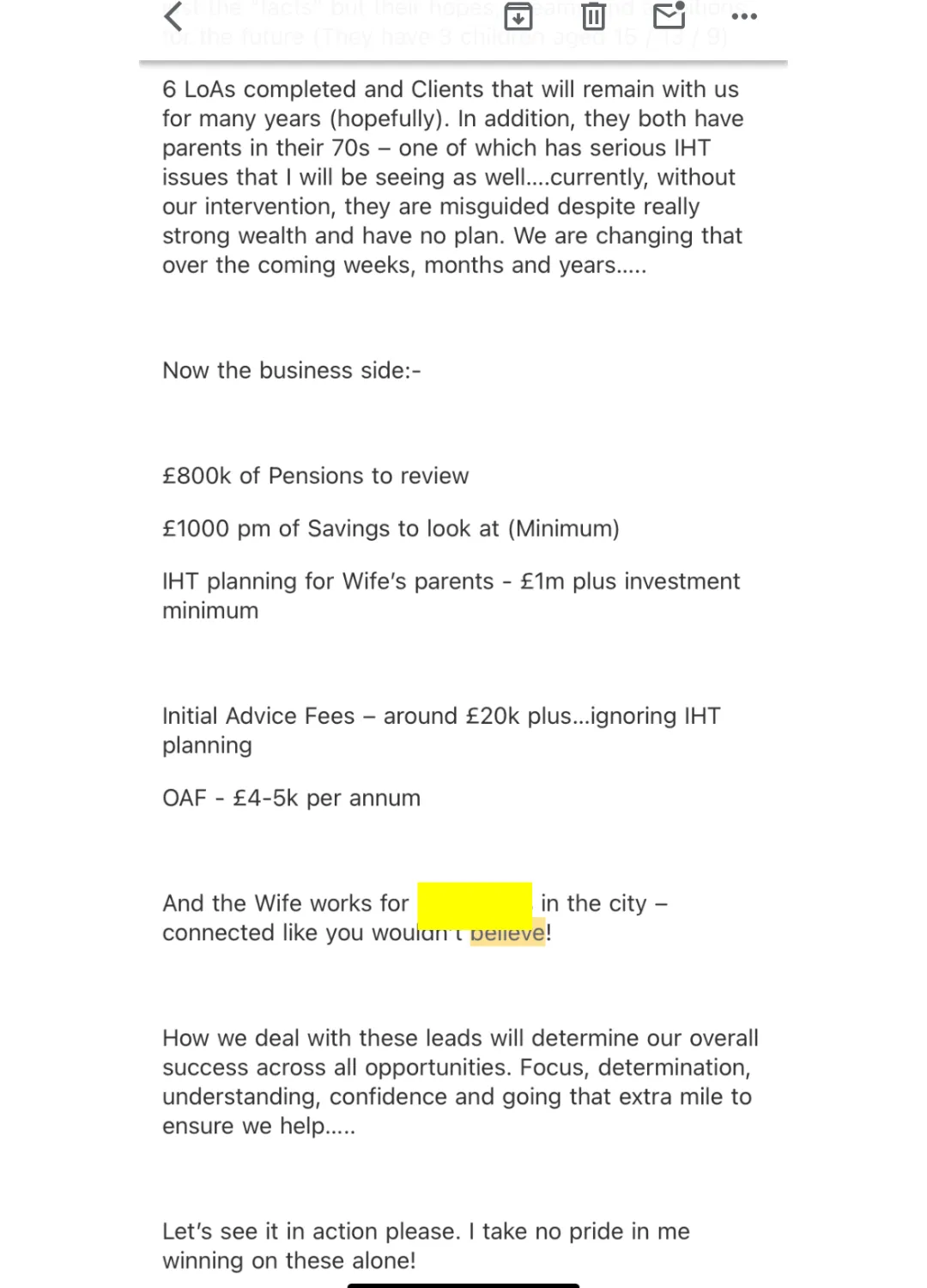

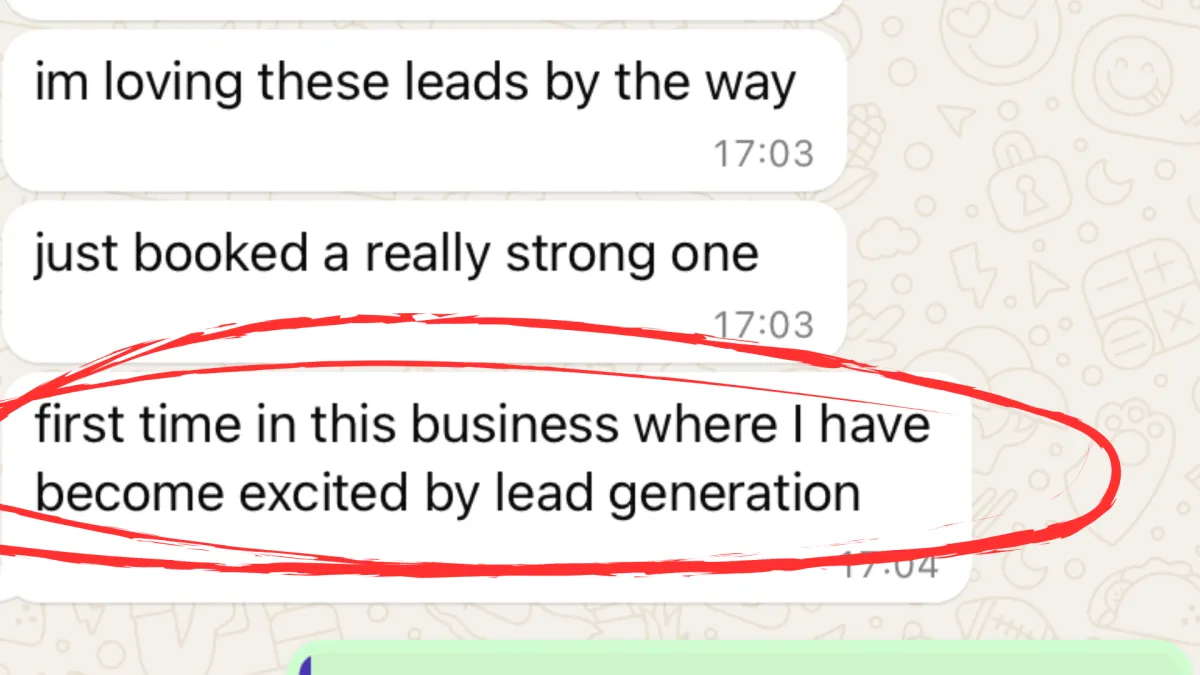

It has been an extremely rewarding process, seeing my clients go from the frustration of having tried everything to scale their firms, to doing so predictably and reliably, and knowing they are building something sustainable

Prior to working together, many of our clients were wasting time delaying because they were lost, or they were caught up on being burnt in the past. Mostly though, they were already incredibly successful firms, but looking to get to the next level with a scalable model.

Regardless of where they were, my favourite feeling is always at some point in week 1 when they start booking their first appointments with great, open-minded prospects and realise they are onto a winning strategy.

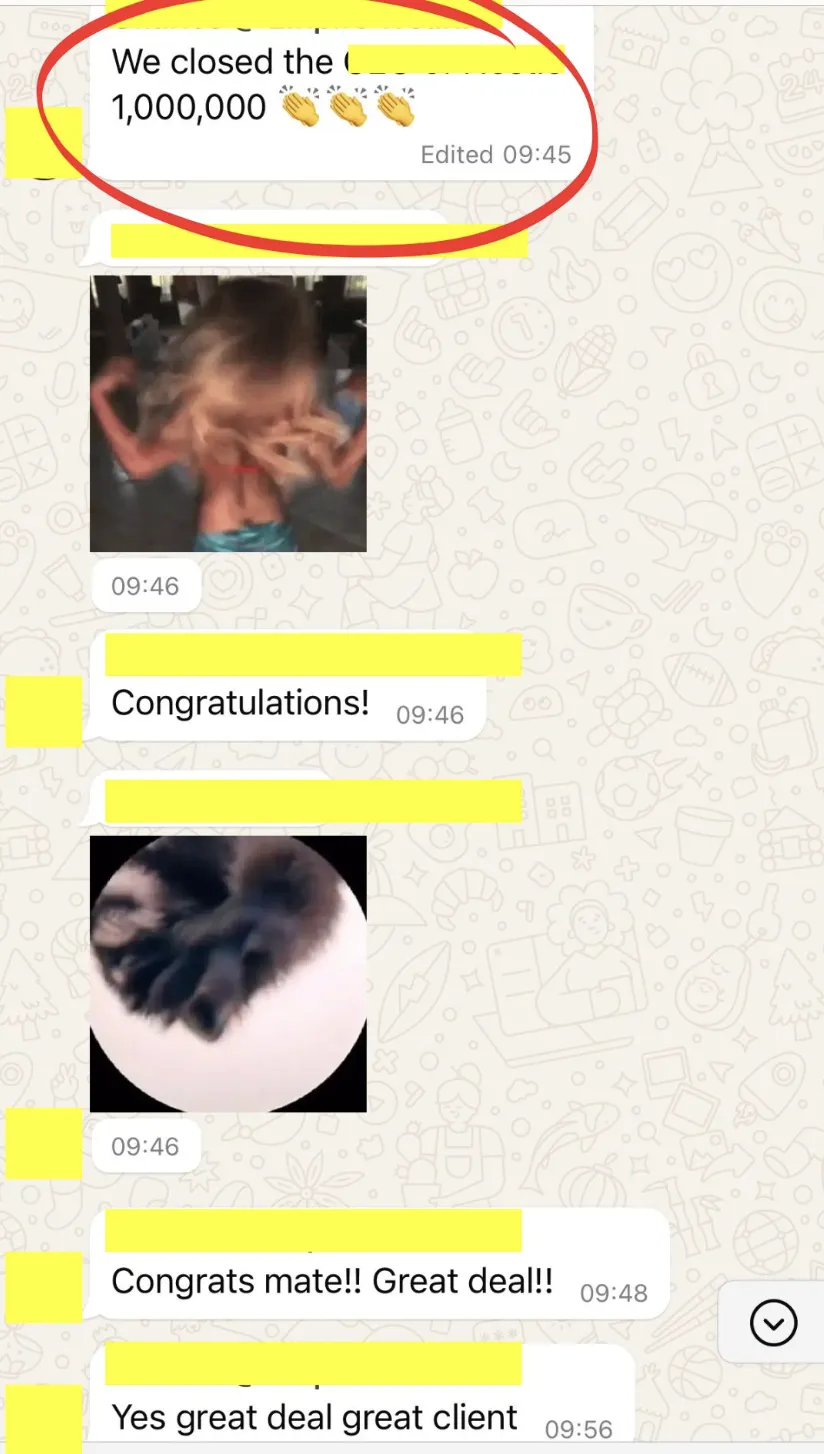

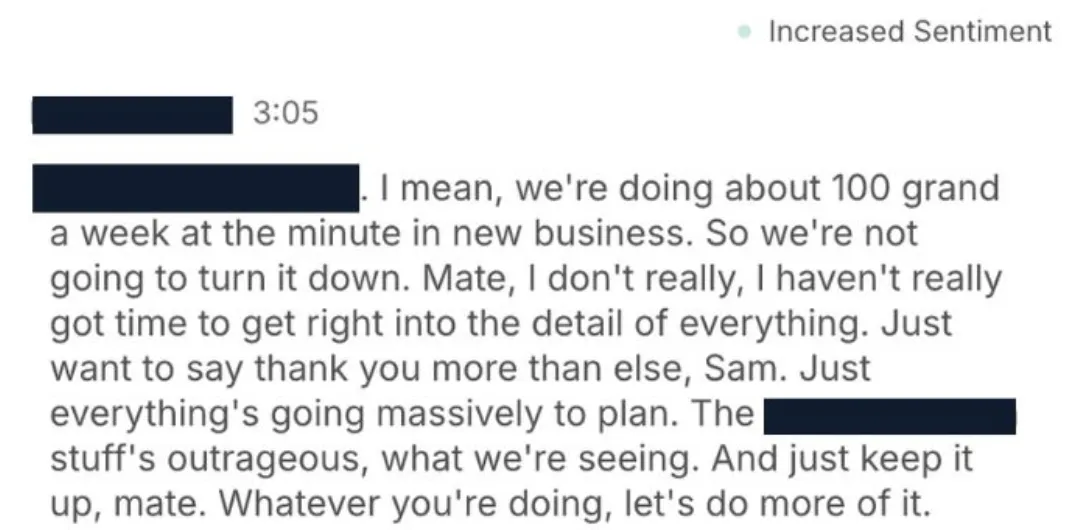

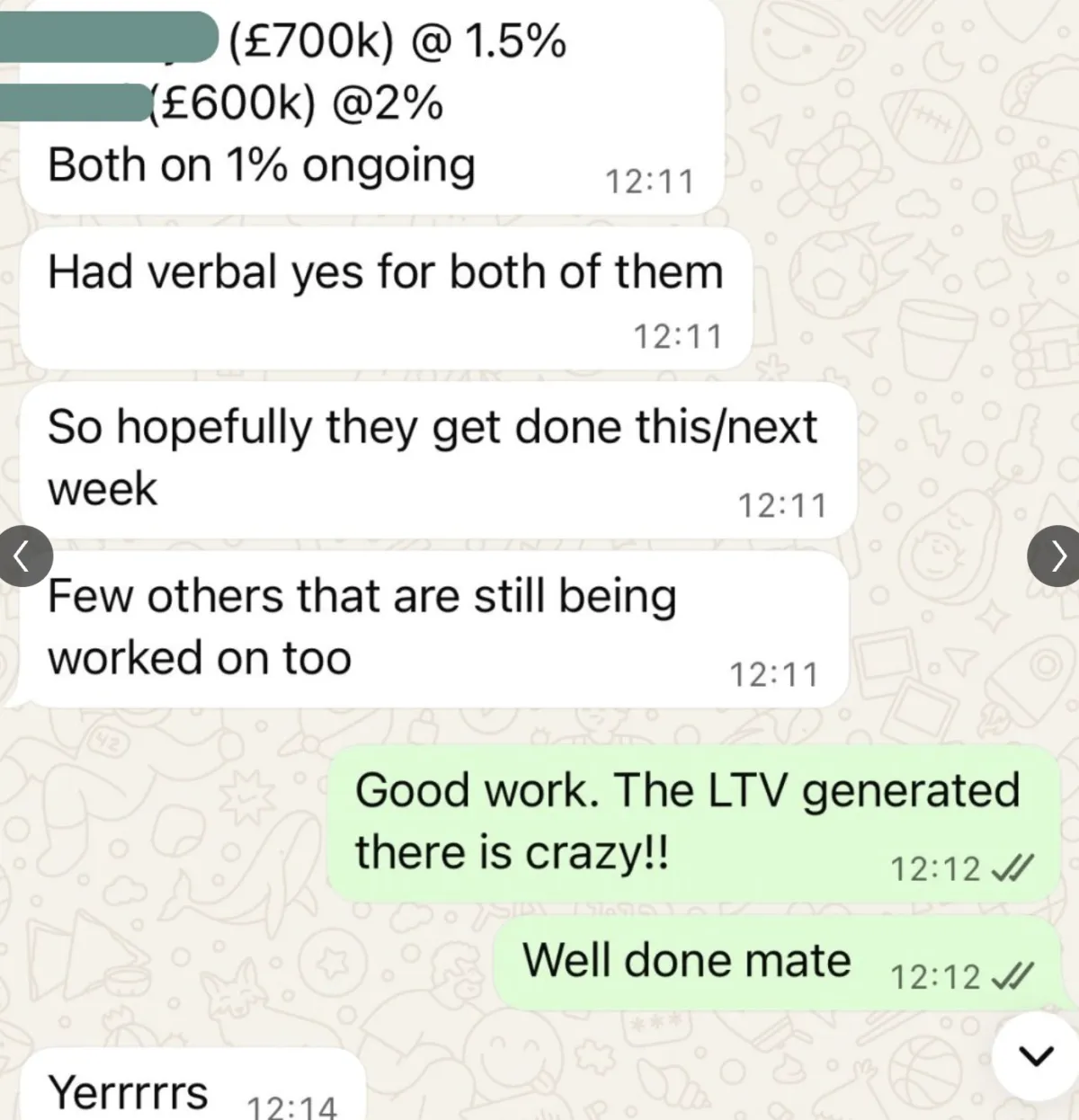

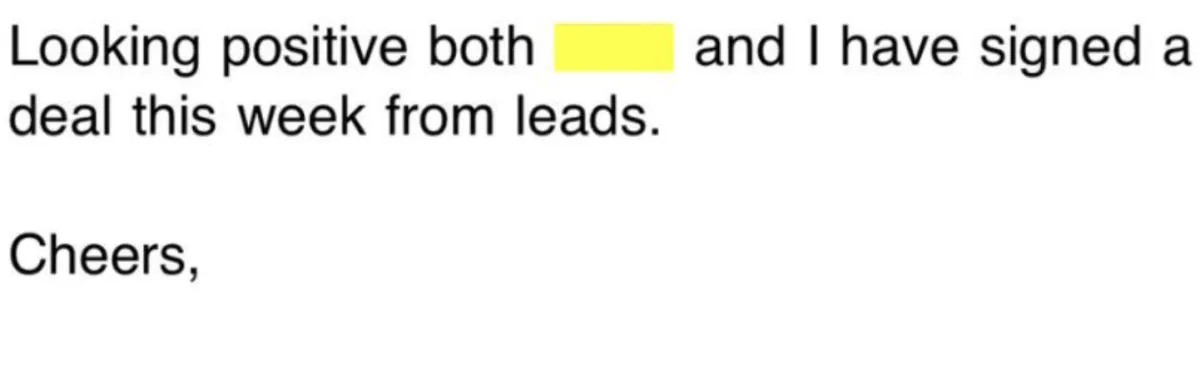

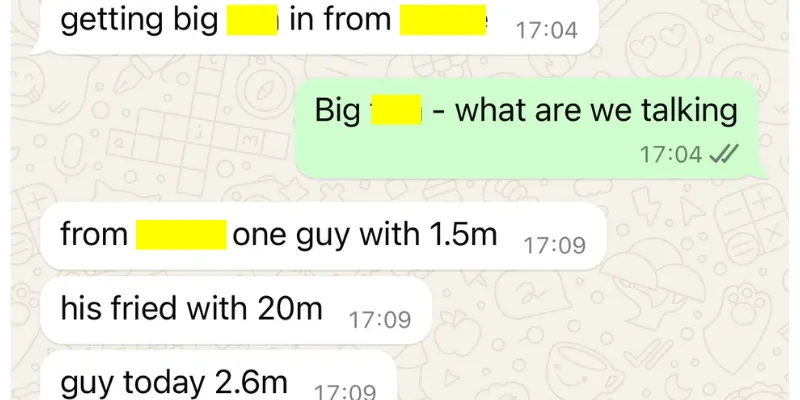

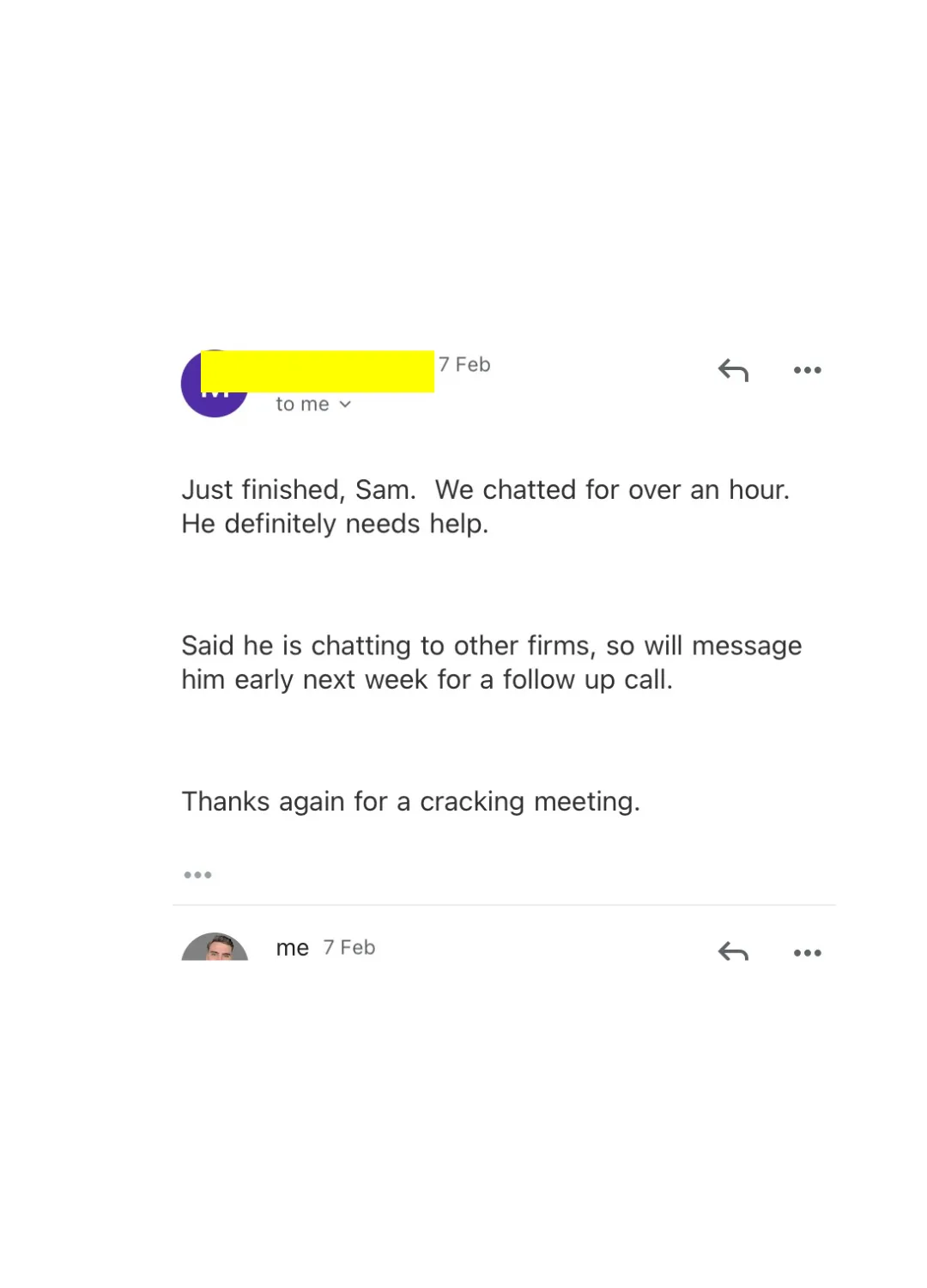

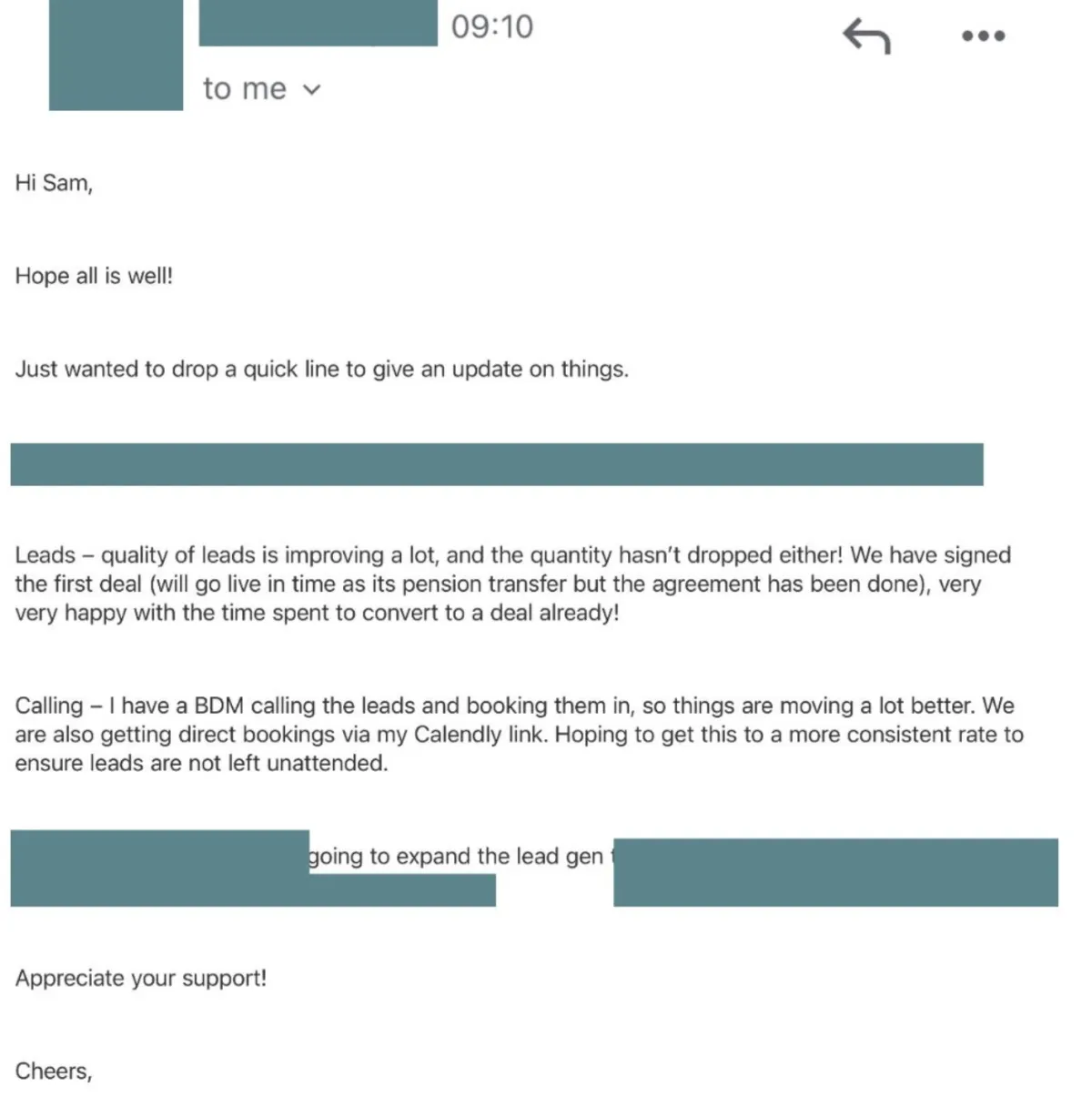

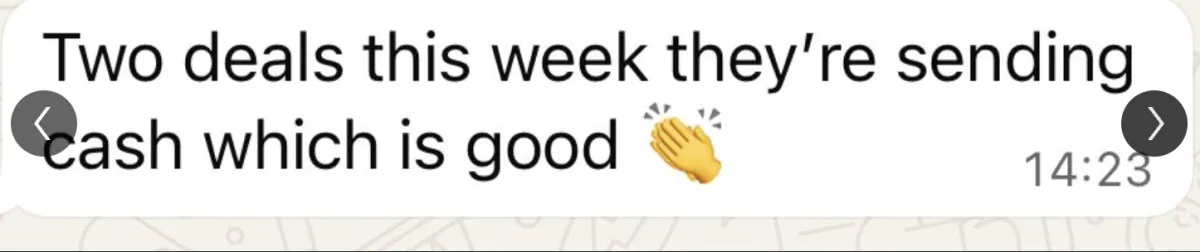

That feeling is closely followed by receiving messages of updates on the great clients they've signed and families they have helped. (Find some examples attached at the bottom of the page!).

The mission of the company now is simple, every day, my team and I focus on "making wealth management client acquisition easy".

Whilst you will always still have to put in the work on your side, we strive to get as close as we possibly can to "easy", and ensure our clients are the beneficiaries.

So whether you have been burnt in the past, or have been achieving good, but not great growth, please don't hesitate to book your free discovery call to see what we can achieve for you and your business.

To your success,

Sam

You Don't Just Need Leads,

you need an AUM Growth Partner.

How Are We Different?

Many firms we speak to have been burnt in the past by other marketing companies, and you may be wondering how we are different...

BELOW WE BREAK DOWN THE MOST COMMON 4 BROKEN MODELS TO AVOID, WHEN IT COMES TO WEALTH MANAGEMENT CLIENT ACQUISITION.

Broken Model 1: Lead Providers

Every adviser thinks they need leads, so they transactionally buy off-the-shelf leads. But this is shortsighted.

To achieve sustainable AUM growth, you need your own system. One that is tailored to you and your needs over time. Not one that is one-size-fits-all, built to serve hundreds of firms in your country.

Given the one-size-fits-all, transactional nature of the lead provider-to-adviser relationship, we rarely see long term success because of the disconnect between the two parties.

What we do differently, is we work in tandem with you to listen to your feedback and implement changes that will help drive growth in your AUM, not just more names and numbers.

Every single change we make to your campaigns, is for you, and only you. And there is a clear communication loop so we are working cohesively.

Lead providers cannot adapt their entire approach for 1 firm when they serve hundreds. We believe this is a broken model and doesn't best serve the adviser long term.

Broken Model 2: Other Agencies

Perhaps they're a family friend, or perhaps they sent you a ludicrous claim by email or LinkedIn, or perhaps they have a snazzy office...

For whatever reason you have come across a marketing agency that claims they fully understand the wealth management space and have a "proven system" to get you more clients. They may have even recently learnt industry buzz words like "AUM" or "High-Net-Worth".

What most firms don't do at this point, and why there are so many horror stories, is..

DUE DILIGENCE!

If you look a little further into their background, the chances are their testimonials are from jewellery companies, HVAC businesses, gyms... not wealth management firms. The truth of the marketing industry, is many agencies bounce from industry to industry once their reputation dies out, hoping the next one will be "easier".

If you were to probe on their knowledge of the industry, they likely have zero experience in prospecting in your space. And if they have never spoken to a wealth management prospect before, it is incredibly unlikely they will know what really drives them. And thus, their ability to make you stand out online will be limited.

But BE WARNED...

This is the trap you are statistically likely to fall into, because one of them will inevitably make you a crazy guarantee that sounds like a "no-brainer".

A no-brainer until you've wasted 6 months of potential growth you can never get back.

Our difference is we have only ever worked in the wealth management space, on both the lead generation and the prospecting side, with the best of the best firms in the industry... so there's no disconnect, we take responsibility for AUM growth - not just lead generation.

The Founder's role at Fisher Investments involved speaking to the leads every day, and training new joiner advisers to handle them. Sam actually works with our clients 1-1 to ensure you have industry-leading lead handling skills.

The other big factor to consider here is paid advertising and client acquisition is driven by data. If you're working with a firm that hasn't worked in this space for a number of years, you are likely to just waste a lot of time and money. When considering the natural cash flow lags in this industry, you simply don't have time to figure it out as you go.

Our data is what sets us apart, we already know what works, allowing our clients to get results from day 1. This has came from years of granular testing with our clients, and learning from multi-millions in advertising spend.

Broken Model 3: Word of Mouth

Word of mouth is amazing. It's how our business has grown. And we encourage it for you.

However, it can only take you so far. You can't put in 10k, and get back x referrals. Your success has a cap and is totally reliant on third parties. Whether you are willing to settle for that is totally dependent on you and your goals.

Neither is right or wrong, although we only work with those that are not satisfied with that cap.

If you want to build an acquisition system that you can scale on command, word of mouth is not the answer.

Broken Model 4: Cold Outbound

Again, with cold outbound there are a lot of firms that have had a lot of success.

If this is you, great job and congratulations.

But if you can convert cold leads that your team needs to work manually to dig out... imagine what you could do with a scalable flow of warm ones?

What we always find is the firms and advisers that have been able to convert cold leads into business, are positioned amazingly well to convert warm ones, and achieve the fastest, most aggressive growth with us

We position them with a scalable model that doesn't require hiring, managing and training a bunch of demoralised BDM's, and their growth trajectory experiences a big boost pretty quickly!

If You're Serious About Scaling Your Assets Under Management...

Let's build your acquisition system right, and let's build it once.

Open To Becoming An AUM Growth Partner?

Find out how to scale your AUM predictably & consistently in 2026...

Burrows & Partners Ltd. 2025

Privacy Policy | Terms and Conditions